.jpg)

Real estate pricing

The value of real estate can be easily summed up based on the location of the plot, its size, the value of various resources invested. On the other hand, the price is more difficult to determine in a “dynamically” changing environment, where properties find a new owner with a mixture of different and different purposes.

The value of real estate can be easily summed up based on the location of the plot, its size, the value of various resources invested. On the other hand, the price is more difficult to determine in a “dynamically” changing environment, where properties find a new owner with a mixture of different and different purposes.

There is an increasing demand for speculative or spending purchases, which easily upsets the normal functioning of the market. For this reason, in recent years it has been more appropriate to determine the price of the property, taking into account the value of the property less and weighing the prices of similar properties on the current market. The problem was further aggravated by the fact that this pricing had to be adjusted quite frequently to the market, since even after a month the price of similar properties could change by percentages. We were able to help a real estate agency in this matter within the framework of a project.

Since in the present we want to get the price of the property and not predict its change for a future period, so the problem can also be described by a simple regression. As a first step, we must differentiate between the objective and explanatory variables. The target is the price of the property, and the explainers are the attributes that best explain the evolution of the price. Although these factors can vary greatly from region to region, in most cases the following variables are the minimum requirement for determining the price of a property:

- Appointment

The date of listing or searching for the property. It is enough to indicate the year by month and possibly the quarter, so it is easier to follow which quarters there was a greater increase or decrease, or a combination of these, which gave rise to volatility. It is important to note that there may not be only marginal differences between the advertised price and the price of the property actually sold, since the advertised price may not be fixed and the buyer may also be attentive enough to be able to bargain well. This is greatly influenced by how quickly the seller wants to sell the property.

- Properties of real estate

The properties of real estate can be divided into two large groups. The first and perhaps most important are the different dimensions such as property, terrace, plot areas, number of rooms and their design, ceiling height and other features that do not reflect the condition of the property. Of course, do not forget about the year of construction and the infrastructure built.

The more conspicuous and at the same time more subjective elements cover the condition of the property, which can be solved for simplicity with a simple scoring system, however, if we take only a scale of five as a basis, there can be big differences between average and luxury properties and we cannot simply mark the former and five with a triple with the latter. Descriptions can help us with this, which may include whether the property is renovated or possibly in need. If we also want to take these as a basis for estimating the price of real estate, it is also necessary to decode these sentences. Using only these descriptions for modeling is of course risky, since it depends on the individual how he describes the particular factors, however, supplementing it can be a sure help.

- Surroundings and location

We cannot go without saying about the location of the property, because a similar property is located in Pest or Buda, or maybe in other and other cities, it very much determines how much it costs. It is important to mention in the case of the property where you look, as it does not matter whether it is a quiet courtyard or a busy street. In addition, it is necessary to take into account the service options in the vicinity of the property, the demand for which may vary from life cycle to life. After all, it is still important at a young age that either entertainment venues or school are available, later the workplace, shopping facilities, pharmacy then kindergarten, school, etc.

To identify nearby services, we used OpenStreetMap, available to anyone, which, like Google Maps, covers not only road networks, but also different services in the regions. During the project, using the coordinates of the properties, we collected the services located in their vicinity, which can have a positive effect on the evolution of prices. In addition, we have summarized public transport options and major travel hubs.

- KSH data

The price of real estate is influenced by the locality but also the conditions of the region. We can talk either about the proximity of the Lake Balaton wine region, or the unemployment rate in the district, or simply the number of new apartments. Although the KSH data of the region does not play a big role in a large average, however, these factors must also be taken into account in order to predict the price as accurately as possible.

Of course, it is not necessary for the interested person to know how far the nearest shopping center is located from his plot or how much the average earnings in his locality are, it is enough to share only the most important qualities about his property. But of course, the more information a user shares, the more accurately our model can predict.

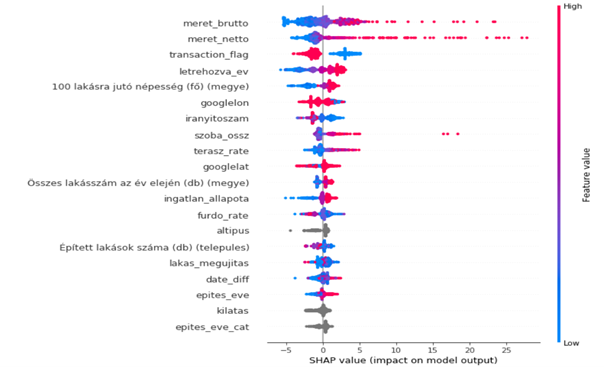

In the image above you can see the properties of the property and region and their effect on the price, if the scale is red, it increases the price of the property, indicating in blue the reverse direction. These effects are clearly visible for the first couple of variables, since as the gross and net size increases, the price of the property will also increase, but it will also affect the transaction or starting price mentioned earlier and when the real estate ad was created.

But what exactly tells the price and how accurate it is, the user can rightfully ask. Already from the variables it is clear that there is not necessarily a linear relationship between each variable, so we needed a more complex modeling than linear regression. To keep it simple for users to interpret, we opted for a modeling consisting of a group of decision trees. At this point, each tree appears as only a weak learner, only meeting a portion of the variables, however, by comparing this information, a strong learner can be created.

Although it seems convincing at first, however, what could be the problem with this modeling? By comparing the information, averaging is carried out, which also entails loss of information, however, for average properties that occur in large numbers, the procedure works very well. So, the average estimate of panels, apartments, single-family houses will be appropriate, however, in the case of huge lofts or properties with rose hips, the model underestimates the price of the property.

To reassure you, this problem can also be addressed if we design the learning sets immediately with the awareness that we try to put properties with more unique characteristics into a segment and develop different models for these formed groups. Thanks to this, everyone can get the best possible price according to the market in a few minutes and you do not have to comb through all similar properties to determine the best price.

The result of our development is used by the real estate agency company to support their employees, that is, the realtor colleague will receive an estimated guide price immediately after entering the data for the apartment. You can compare this with your own or the seller's ideas, so it is easier to form a realistic selling price.